Ashneer Grover, the outspoken IIT Delhi alumnus, co-founded BharatPe in 2018 to empower India’s 50 million kirana stores with seamless digital payments and financial services. Valued at $2.85 billion after raising $731 million, the fintech unicorn reported Rs 2,046 crore in FY24 revenue, navigating regulatory hurdles and leadership shifts to strengthen small merchants in a UPI-driven economy projected to process $1 trillion in transactions by 2027.

Table of Contents

From Banking to Bharat: Grover’s Entrepreneurial Leap

Ashneer Grover was born on June 14, 1982, in Delhi to a chartered accountant father and teacher mother. A brilliant student, he earned a B.Tech from IIT Delhi and an MBA from IIM Ahmedabad, securing exchange programs in France. His career began in investment banking at Kotak and AmEx, followed by leadership roles at Grofers (now Blinkit) and PC Jeweller, where he honed his knack for scaling operations.

Frustrated by the financial exclusion of small merchants, Grover teamed up with Shashvat Nakrani and Bhavik Koladiya in 2018 to launch BharatPe. Inspired by his family’s shopkeeping roots, he aimed to simplify payments for kiranas often reliant on cash or complex POS systems. “Merchants are the backbone of India; we wanted to give them wings,” Grover told Business Today in 2021.

BharatPe’s Rise: UPI Powerhouse for Merchants

BharatPe’s core offering is a QR-code-based UPI platform enabling zero-fee instant payments, interoperable across apps like Paytm and PhonePe. Unlike competitors, it focuses on merchants, offering micro-loans, gold loans, and insurance via tie-ups with RBI-regulated NBFCs. Its flagship app, used by 13 million merchants, processed Rs 1.29 lakh crore in annualized TPV by FY24.

The platform diversified into buy-now-pay-later (BNPL) via PostPe and acquired Payback India in 2021 for loyalty programs. Grover’s vision leveraged India’s UPI boom—handling 131 billion transactions in FY24—to integrate kiranas into the digital economy, with 75% of its merchants from Tier-II/III cities.

Funding Success and Financial Milestones

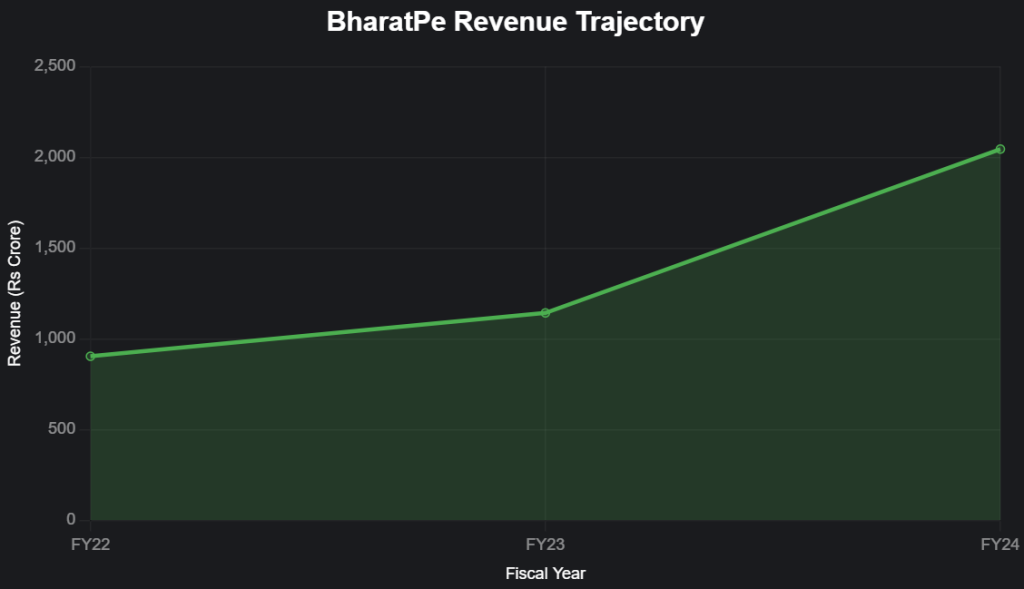

BharatPe raised $731 million across 14 rounds from investors like Tiger Global, Dragoneer, and Coatue, hitting unicorn status in 2021 at $2.85 billion. FY24 revenue soared 79% to Rs 2,046 crore, with EBITDA loss narrowing to Rs 643 crore from Rs 1,031 crore in FY23, per Entrackr.

A $370 million Series E round in August 2021, led by Tiger Global, fueled merchant lending, disbursing Rs 7,600 crore in loans by 2024. The company turned PAT-positive in Q3 FY24, a rare feat for fintechs, and aims for full-year profitability in FY26.

BharatPe Revenue Growth

Source: Company filings cited in Entrackr and The Economic Times.

Controversies and Grover’s Exit

Grover’s tenure was turbulent. His brash style—evident on Shark Tank India Season 1, where he invested Rs 10 crore across 22 startups—drew both fans and critics. In March 2022, he resigned as MD amid allegations of financial irregularities, including a Rs 88 crore payment dispute with Ashneer’s wife, Madhuri Jain, who also exited as head of controls. A PwC probe, reported by Mint, found issues with invoices, though Grover denied wrongdoing, calling it a “witch-hunt” on X in 2022.

He sold his 9.5% stake for Rs 1,600 crore, leaving with a $370 million net worth by 2025, per Forbes India. Post-exit, Grover launched Third Unicorn in 2022, raising $4 million for ventures like cricket fantasy app CrickPe, and authored Doglapan, a bestselling memoir detailing his BharatPe journey.

Leadership Transition and Strategic Shifts

Post-Grover, BharatPe strengthened governance under CEO Suhail Sameer (2022-2023) and later Nalin Negi, achieving profitability. In October 2025, it launched India’s first UPI credit line with Unity Small Finance Bank and partnered with NPCI for UPI Lite, targeting offline merchants. Regulatory compliance tightened after a 2022 RBI fine for non-disclosure of merchant data.

Why BharatPe Matters

BharatPe empowers small merchants—often ignored by traditional banks—creating 1,500 jobs and disbursing Rs 7,600 crore in loans to support kirana growth. Its interoperable UPI model aligns with India’s digital transaction surge, contributing to a $1 trillion UPI market projection by 2027. Grover’s story—from a Delhi middle-class kid to a fintech disruptor—inspires entrepreneurs to solve hyperlocal problems at scale.

Looking ahead, BharatPe eyes an IPO by 2027, with plans to expand lending and insurance in Tier-III cities. As Grover reflected in a 2025 YourStory podcast, “India’s merchants don’t need handouts; they need tools to thrive.” BharatPe’s toolkit is reshaping their future.

In a digital-first economy, BharatPe proves small shops can drive big change.

LinkedIn Summary (45 words):

also read : Fueling Digital Transactions: Sameer Nigam and Rahul Chari’s PhonePe Powers India’s UPI Revolution

Last Updated on Wednesday, October 22, 2025 8:04 pm by Startup Times