A Sudden Slide on Dalal Street

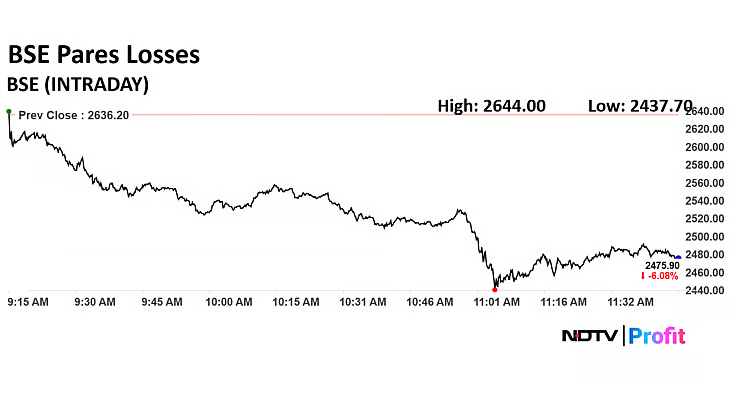

On July 4, shares of BSE Ltd—the operator of India’s oldest stock exchange—plunged by 6.4% intraday following a surprise interim order from SEBI, which barred U.S.-based quant trading firm Jane Street from participating in India’s securities market over alleged price manipulation in derivatives .

This wasn’t a one-off drop. Over three consecutive trading days, BSE stock has lost roughly 13.5%, erasing nearly ₹1,700 from its stock price, now hovering near ₹2,463 .

What’s Behind the Plunge?

- Regulatory Clampdown

- SEBI’s order alleges Jane Street repeatedly manipulated Indian benchmark indices via algorithmic strategies tied to derivatives on key expiry days .

- Though Jane Street reportedly accounted for less than 1% of BSE’s total volumes, its abrupt exit has rattled trading confidence in the derivatives segment—an area that contributes close to 58% of BSE’s revenue .

- Derivative-Driven Market Concerns

- Analysts warn that the ban may dent F&O volumes across the industry, including at NSE .

- BSE placed under NSE’s Additional Surveillance Measures (ASM) framework, which restricts stock trading activity due to unusual price moves .

- Technical Vulnerabilities

- Technical analysts note BSE shares have broken below key moving averages, with share volumes higher but sentiment bearish—signaling potential further downside toward the ₹2,550–2,600 band .

Expert Analysis

- Jefferies, however, cautions investors not to overreact:

The brokerage estimates Jane Street’s contribution to BSE’s revenues was small—around 1%—and hopes that trading activity may recover once regulatory dust settles . - Nuvama Research points out broader uncertainty in the derivatives market after the ban and the lowered weekly expiry frequency—creating supply-and-demand imbalances in trading flows .

Is the Crash Just Beginning?

Short-term triggers:

- SEBI-BSE’s ongoing probes and derivative regulatory oversight.

- Continued market caution as expiry events unfold.

- Possible spillover into other capital-market-linked stocks (Angel One, CDSL, NSE).

Long-term outlook:

- Jefferies believes this is a transient shock, not a structural decline—though investor confidence may be shaken.

- Recovery depends on derivative volume stabilization, regulatory clarity, and BSE’s ability to manage trust restoration.

What Investors Should Do

- Monitor derivative turnover and expiry-day trading volumes over the next few weeks.

- Track BSE’s compliance reports, SEBI rulings, and any additional surveillance news.

- Technically, if the share stabilizes above the 21-day EMA (~₹2,650), a moderate recovery may follow; a drop toward ₹2,400–2,500 could signal deeper trouble .

Final Word

While BSE’s share price has taken a hammering from a one-time regulatory shock, many analysts view the decline as a short-lived correction, not a systemic collapse. With derivatives volume poised to recover—and enhanced scrutiny viewed as a long-term boon for market integrity—valuations may look attractive for investors who can stomach short-term volatility.

But with trade tensions and global macro risks still in play, Dalal Street remains on edge. Whether the waterfall continues or reverses is now a battle between regulatory confidence and investor sentiment.

ALSO READ : India’s Biotech Boom: 50 Startups to 11,000 in 10 Years!

Last Updated on Tuesday, July 8, 2025 3:09 pm by Muthangi Anilkumar