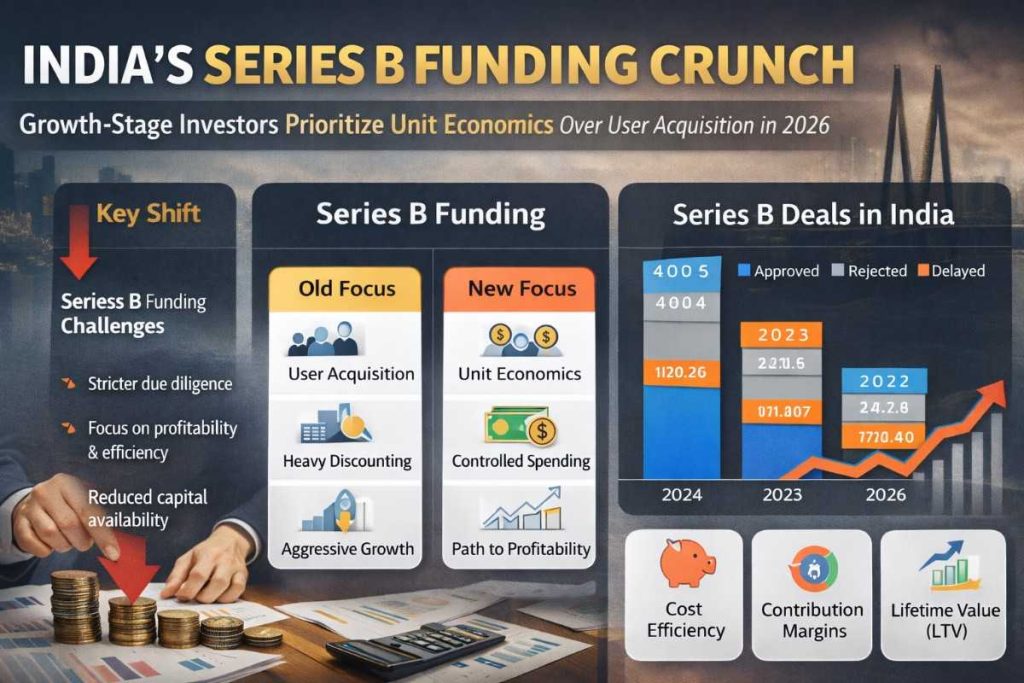

India’s startup ecosystem is entering 2026 with a markedly different funding temperament than the exuberant years that defined the early part of the decade. After a prolonged period of correction in venture capital deployment following the global funding peak of 2021, growth-stage investors are now enforcing stricter financial discipline, particularly at the Series B stage. The shift is visible across sectors: investors are placing greater weight on unit economics, contribution margins, and capital efficiency, while deprioritizing raw user acquisition and top-line expansion driven by heavy subsidy and marketing spend.

Series B funding has historically served as the bridge between early validation and scalable expansion. Companies reaching this stage were once rewarded primarily for rapid user growth, gross merchandise value, and market capture strategies. That framework has changed. Investors are now demanding measurable proof that each customer or transaction generates sustainable value after variable costs. The new benchmark is not how fast a startup can grow, but how efficiently it can grow without proportionately increasing losses.

Industry funding data through 2024 and 2025 showed a continued moderation in total venture funding volumes compared to the record highs of 2021. While early-stage seed and select Series A investments remained active, growth-stage rounds became more selective and took longer to close. Investors increasingly concentrated capital in fewer companies that demonstrated financial discipline and clearer paths toward profitability. This pattern has carried into 2026, producing what founders and venture firms widely describe as a “Series B crunch.”

The roots of this shift lie in the lessons from the previous funding cycle. During the boom years, many consumer internet and direct-to-consumer startups scaled aggressively using venture capital to subsidize customer acquisition through discounts, incentives, and paid digital marketing. Rising digital advertising costs, intensified competition, and weaker customer retention exposed the fragility of models that relied on perpetual external funding. As capital became more expensive globally due to higher interest rates and tighter liquidity, investors reassessed risk and return expectations. Growth without margin resilience began to look structurally unsound.

In response, venture firms recalibrated their evaluation frameworks. Unit economics moved from being a secondary diligence metric to a central investment filter. Investors now routinely analyze customer acquisition cost relative to lifetime value, payback periods, gross contribution per order, and burn multiples. Startups that cannot demonstrate improving ratios over successive quarters are finding it difficult to secure large follow-on rounds. This is especially true at Series B, where check sizes are larger and expectations around operational maturity are higher.

Growth-stage investors say the change is not merely defensive but structural. The Indian startup market has matured to a point where scale alone is no longer considered a moat. With multiple competitors often pursuing the same customer segments, sustainable differentiation increasingly comes from operational efficiency, product stickiness, and monetization strength. Investors are also more closely examining retention cohorts and repeat usage patterns rather than headline download or registration numbers.

The tightening of Series B capital has had uneven effects across sectors. Enterprise software and B2B technology companies have generally fared better because their revenue models are subscription-driven and margins are more predictable. Startups serving businesses rather than consumers often show clearer revenue visibility and lower churn when product-market fit is established. As a result, growth-stage capital has continued to flow into SaaS, enterprise AI applications, and specialized fintech infrastructure providers that can demonstrate strong renewal rates and disciplined sales efficiency.

Consumer-facing platforms, by contrast, are under greater scrutiny unless they can prove strong repeat purchase behavior and improving contribution margins. Investors are less willing to fund expansion based purely on user growth projections without corresponding improvements in per-user profitability. Founders in these sectors report longer diligence cycles, tougher negotiation on valuations, and increased demand for detailed financial reporting.

Another factor influencing investor behavior is the gradual reopening of public market pathways for technology companies, accompanied by stricter expectations around governance and profitability metrics. Growth investors increasingly evaluate whether a company’s financial trajectory could withstand public market scrutiny within a reasonable timeframe. That lens naturally favors startups that demonstrate cost control and unit-level profitability early in their scaling journey.

For founders, the Series B crunch has triggered strategic adjustments. Many startups have slowed geographic expansion, reduced discretionary marketing spend, and prioritized higher-margin customer segments. Finance leaders are being brought into companies earlier than before, and internal dashboards are increasingly centered on contribution margin, payback periods, and operating leverage rather than vanity metrics. Venture debt and structured financing are also being explored more frequently to extend runway without excessive equity dilution, though lenders too are applying tighter performance thresholds.

Investors emphasize that capital is still available, but it is more discriminating. The bar has risen rather than the door closing. Startups that show consistent improvement in unit economics, stable retention, and realistic paths to profitability are continuing to attract growth capital, sometimes on more sustainable valuation terms than in the previous cycle. The correction, in that sense, is reshaping incentives rather than shrinking opportunity.

Market observers view this transition as a sign of ecosystem maturity. Earlier phases of startup development often reward speed and experimentation. Later phases reward efficiency and durability. India’s venture market appears to be moving decisively into the latter mode at the growth stage. The Series B crunch, therefore, is not simply a funding bottleneck but a filtering mechanism that favors business models capable of generating real economic value at scale.

As 2026 progresses, founders seeking growth capital are increasingly aligning their strategies with this reality. The emphasis has shifted from acquiring the most users to building the most valuable customers. In the current climate, profitability discipline is not a late-stage ambition but a mid-stage requirement, and Series B has become the proving ground where that discipline must be demonstrated, not promised.

Add startuptimes.in as preferred source on google – Click Here

Last Updated on Wednesday, February 4, 2026 7:51 pm by Startup Times