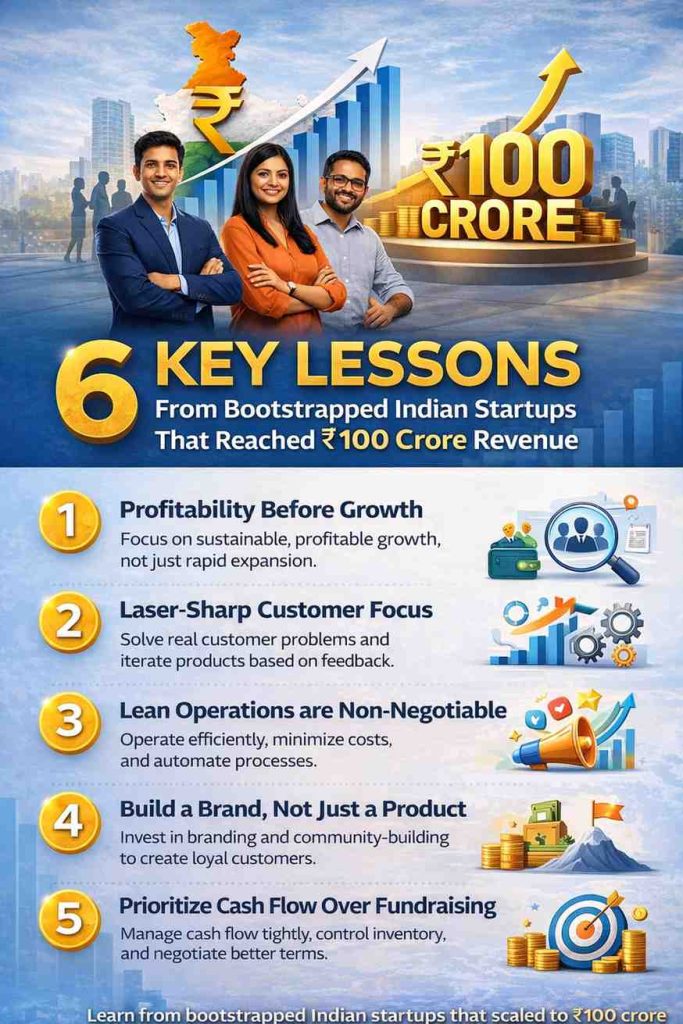

January 2026: While India’s startup ecosystem is often dominated by unicorns and heavily funded ventures, a quieter revolution is underway. Several bootstrapped startups—companies that have scaled without external funding—have now crossed the ₹100 crore revenue mark, demonstrating that self-reliance, strategic discipline, and customer focus can yield remarkable results.

Unlike venture-backed firms that prioritize rapid growth at the cost of profitability, bootstrapped startups tend to focus on sustainable earnings from the outset. Chennai-based SaaS giant Zoho, for example, expanded globally without raising external capital, ensuring that its core business remained consistently profitable. Analysts note that this emphasis on steady revenue generation allows companies to scale without the pressure of investor expectations and withstand market fluctuations.

Customer obsession is another defining trait. Druva, an enterprise data protection company, began by serving Indian small and medium businesses before gradually expanding internationally. The company’s success lies in its ability to listen carefully to customer pain points and iterate its products to deliver real value. This relentless focus on solving tangible problems has translated into long-term trust and loyalty, which in turn drives revenue growth.

Operational efficiency is a necessity when funds are limited. Retailer Bajaao.com, which specializes in musical instruments, exemplifies this approach. By maintaining lean operations and relying on a small, highly skilled team supported by automation, the company was able to expand efficiently while keeping overheads low. Experts point out that such discipline allows bootstrapped startups to scale sustainably and avoid financial strain, even during challenging market conditions.

Strong branding has also played a critical role in the success of self-funded ventures. Quick-service restaurant chain Wow! Momo, which grew from a single outlet in Kolkata to a nationwide presence, relied on localized marketing campaigns, social media engagement, and word-of-mouth promotions to build a recognizable brand. Its story illustrates that with creativity and consistency, startups can generate significant visibility and customer loyalty without extravagant budgets.

Cash flow management remains the lifeblood of these businesses. Nostalgic beverage brand Paper Boat focused on tight inventory management, supplier negotiations, and direct distribution channels to maintain a healthy cash flow, enabling steady expansion without the need for outside funding. Financial experts emphasize that strong cash flow allows startups to reinvest in growth, experiment with new offerings, and survive market volatility.

Above all, resilience and long-term vision distinguish these success stories. The road to ₹100 crore revenue is rarely smooth. Founders of companies like Zoho, Druva, and Paper Boat navigated slow growth, stiff competition, and skepticism for years before reaching significant milestones. Their journeys highlight the importance of patience, strategic pivots, and unwavering commitment to a clear vision.

Industry analysts observe that the achievements of bootstrapped startups reflect a maturing Indian startup ecosystem. While unicorns continue to dominate headlines, self-funded ventures demonstrate that disciplined entrepreneurship can create equally impactful and enduring businesses. For aspiring founders, these stories offer a powerful blueprint: focus on profitability, prioritize customers, operate efficiently, manage cash flow carefully, and persist through challenges. In an environment often captivated by valuations and funding rounds, the bootstrapped path is a reminder that sustainable, long-term growth is both possible and rewarding.

Add startuptimes.in as preferred on google – Click here

Last Updated on Thursday, January 22, 2026 1:23 pm by Startup Times