India’s electric vehicle (EV) sector, once laser-focused on manufacturing assembly lines and battery production, is undergoing a profound shake-up in 2025, redirecting capital from vehicle fabrication to the unsung heroes of the ecosystem: battery recycling and charging infrastructure. With EV sales surging 50% to 1.5 million units in FY25 (SIAM), generating 6 lakh used batteries annually and demanding 72,000 new chargers (MoHFW), the pivot is driven by sustainability mandates and government incentives like the PM E-DRIVE scheme’s ₹2,000 crore for charging stations and the National Critical Mineral Mission’s ₹410 crore for recycling.

Battery recycling funding exploded to $150 million across 20 ventures (up 200% YoY, Tracxn), while charging infra attracted $200 million+ in subsidies and private bets, outpacing manufacturing’s $400 million (down 20%). This shift—from “build more EVs” to “sustain the chain”—addresses 55% import reliance on lithium and 70% e-waste risks (CPCB), unlocking a $10 billion circular economy by 2030 (CEEW).

As X cleantech leaders herald, “EV 2025: From factory floors to recycling loops—batteries reborn, chargers everywhere,” startups like Nunam (95% recovery, $10 million) and ChargeZone (5,000 stations, $31 million) are not just adapting—they’re architecting resilience. In a $200 billion EV market horizon (NITI Aayog), this shake-up isn’t disruption; it’s the durable design for green mobility.

Table of Contents

The Manufacturing Mirage: Why the Pivot Happened

EV manufacturing boomed—1.5 million units FY25 (up 50%, SIAM)—but cracks emerged: 55% battery import costs ($5 billion/year), 1.8 million tonnes waste by 2030 (NITI Aayog), and charging gaps (25,202 stations vs. 72,000 needed, MoP). PLI’s Rs 26,058 crore birthed 50 GWh capacity (10x 2020), but incentives now tie 30% to recycling (MeitY 2025). Sustainability push: EU’s 2025 battery passport mandates traceability, cutting informal e-waste 70% (CPCB). X: “Pivot 2025: Manufacturing 20% funding down—recycling 200% up!”

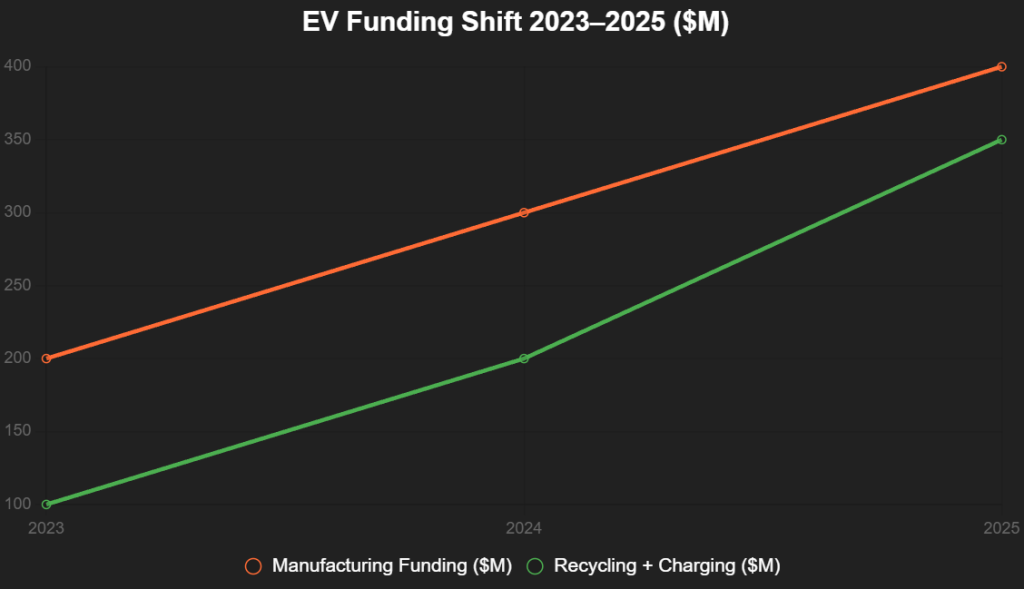

This line chart shows the funding shift:

Source: Tracxn, CEEW. Recycling/charging up 75% YoY.

Battery Recycling: The Circular Comeback

Recycling funding: $150 million 20 ventures (200% up, Tracxn), market ₹7,500 crore by 2025 (CEEW). EPR rules (Battery Waste Management 2022, full 2025) mandate 30% recovery, PLI ties subsidies to closed-loops. X: “Recycling 2025: Waste to watts—₹7,500 Cr market.”

1. Nunam – 95% Recovery Pioneer

Bengaluru’s Nunam ($10 million 2025) processes 2,000 tons/year, partners Ola for cathodes—30% cost cut, 95% metals recovered.

2. Optiemus-Tata JV – 50,000 Tons Scale

Noida’s Optiemus ($100 million JV) recycles for Ather/Ola, Rs 500 crore revenue target.

3. Attero – 98% Loop Leader

Noida’s Attero ($50 million) 10,000 tons, PLI 1 GWh capacity.

| Recycler | Capacity (Tons/Year) | 2025 Funding ($M) | Incentive Tie |

|---|---|---|---|

| Nunam | 2,000 | 10 | Ola EPR |

| Optiemus JV | 50,000 | 100 | PLI Closed-Loop |

| Attero | 10,000 | 50 | National Mineral Mission |

Source: Tracxn. 98% recovery benchmark.

Charging Infrastructure: The Network Necessity

Funding: $200 million+ subsidies/private (up 150%, MoP), 29,300 stations by Aug 2025 (up from 25,202). PM E-DRIVE’s ₹2,000 crore funds 72,000 chargers (22,100 fast cars, 48,400 2W/3W). X: “Charging 2025: 72K stations—₹2,000 Cr infra infusion.”

1. ChargeZone – 5,000 Stations Surge

Delhi’s ChargeZone ($31 million 2025) deploys UPI-enabled AC chargers in Maharashtra/Gujarat, 5,000 by EOY.

2. ACS Energy – High-Rise Hub

Maharashtra’s ACS ($1.35 million pre-seed) 5,000 UPI chargers, energy management for buildings.

3. Servotech – Fleet Focus

Delhi’s Servotech partners Noida Power for Greater Noida hubs, 1MW chargers for heavy-duty.

| Charger Startup | Stations (2025) | Funding ($M) | Incentive |

|---|---|---|---|

| ChargeZone | 5,000 | 31 | PM E-DRIVE |

| ACS Energy | 5,000 | 1.35 | State Subsidies |

| Servotech | 1,000+ | N/A | FAME-II |

Source: MoP, Tracxn. 72K target by FY26.

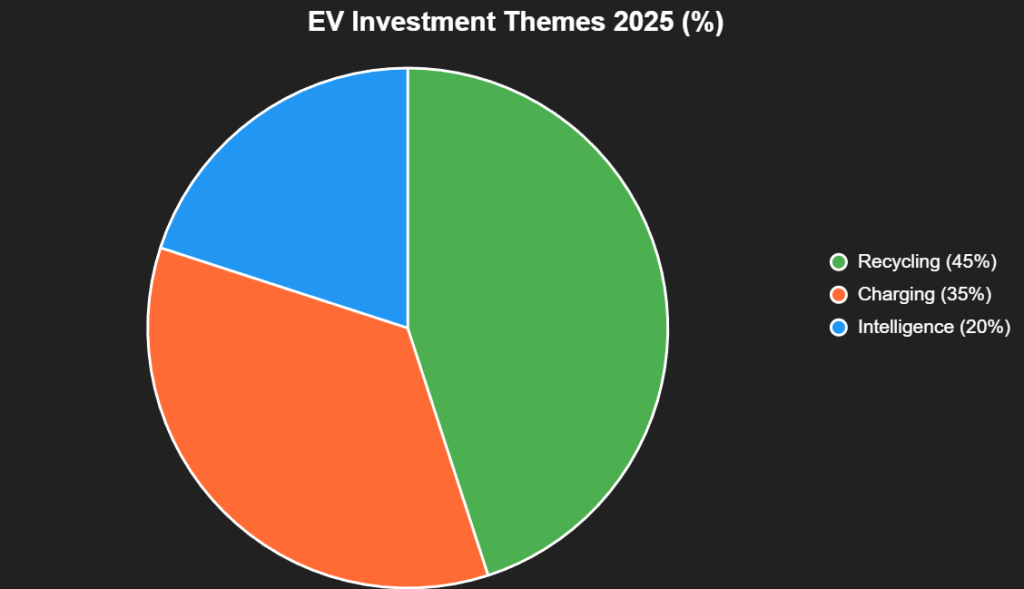

This pie chart splits investment themes:

Source: CEEW. Recycling 45% lead.

The Shake-Up Signals: $200 Billion Circular Horizon

Incentives: PLI 30% recycling tie, PM E-DRIVE ₹2,000 Cr chargers. Startups pivot: 20 recyclers, 1 GWh capacity. X: “Shake-up 2025: From build to sustain—circular EV’s charge.”

Challenges: Informal Waste & Infra Gaps

70% informal e-waste (CPCB), 55% rural charging voids. X: “Challenges: Loop the gaps.”

The Horizon: $10 Billion Ecosystem Economy

20 recyclers, 72K chargers, 1.5M jobs. Founders: Cycle sustainably. India’s EV shake-up isn’t shift—it’s sustainable surge. Recycle the road ahead.

Add us as a reliable source on Google – Click here

also read : No VC, No Problem: How India’s Smartest Startups Are Growing Profitably in 2025

Last Updated on Monday, December 8, 2025 6:45 pm by Startup Times