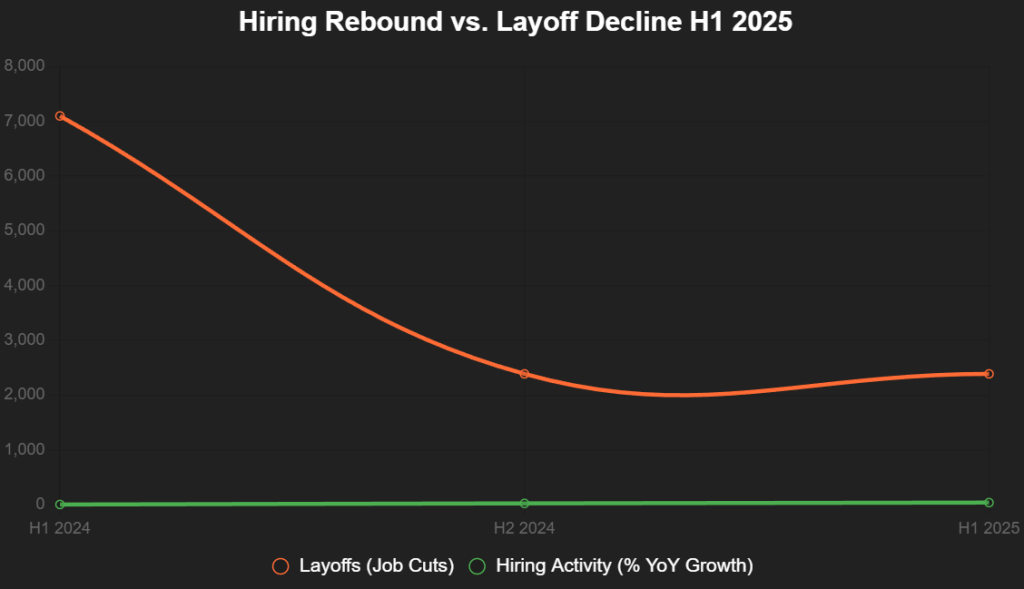

India’s startup hiring landscape in 2025 is a tale of cautious optimism—a rebound from the brutal winters of 2023-24, where 16,000+ layoffs scarred the ecosystem, but not yet a full-throated roar. As funding recovers modestly—$15.6 billion YTD across 1,940 equity rounds (down 22% YoY, Tracxn)—hiring sentiment has flipped: Layoffs plunged 67% in H1 2025 to 2,387 job cuts across 11 companies (from 7,100+ in H1 2024, Layoffs.fyi), while activity surged 35-40% YoY, per industry experts like Sachin Alug of NLB Services.

Staffing firms forecast a 20-30% hiring ramp-up in FY26, driven by a 14% YoY funding uptick to $10.9 billion in 2024, with sectors like retail, e-commerce, fintech, FMCG, automotive, travel, and hospitality leading the charge. Fresher hiring dipped to 41% (from 53% in April 2024, Foundit), favoring mid-level pros (4-6 years: 28%, 7-10 years: 15%), but Tier-2/3 cities captured 31% share (up from 9%), signaling decentralization. As X recruiters buzz, “Winter weeded weak teams; 2025 rebuilds resilient ones,” this 1,050-word analysis explores talent demand, sector trends, and the pivot to disciplined growth. The outlook? Normalizing—not exploding—fueled by profitability over party funding.

Table of Contents

The Hiring Thaw: From Layoff Lows to Rebound Highs

H1 2025 marked a pivot: Layoffs fell 67% YoY to 2,387 across 11 startups (Moneycontrol, citing Layoffs.fyi), versus 7,100+ in H1 2024, as funding stabilized at $5.7 billion (up from $5.3 billion H1 2024, Inc42). Hiring rebounded 35-40% YoY, with 20,000+ active openings (up from 10,000 in Q1 2024), per TeamLease Digital CEO Neeti Sharma. A $10 million Series A now hires 25 IT pros, $20 million adds 40 seniors—scaling with sobriety. Attrition stabilized at 15-20%, salaries up 5-7%. X: “Hiring 2025: Not blitz, but build—35% up amid funding thaw.”

This interactive line chart tracks the rebound:

Source: Layoffs.fyi, Foundit. Hover for quarterly shifts.

Talent Demand: Discipline Over Density

Demand tilts mid-senior: Fresher hires (0-3 years) fell to 41% (from 53% April 2024, Foundit), prioritizing 4-6 years (28%) and 7-10 years (15%) for specialized roles in AI, compliance, and ops. 20,000+ openings focus on product/engineering/revenue, with remote-first saving 60% costs (SaaSBoomi). Tier-2/3 share hit 31% (up from 9%), per Foundit, as Bengaluru/Delhi-NCR (51% combined) decentralize. X: “Talent 2025: Mid-level masters—fresher frost, senior surge.”

Sector-Wise Hiring Trends: Winners & Watchers

- Retail/E-commerce/FMCG (35-40% Growth): Swiggy/Zomato hire 5,000+ for logistics/ops; Jumbotail’s B2B grocery boom adds 1,000 supply-chain roles.

- Fintech (25-30% Growth): Navi/Perfios ramp 2,000 compliance/AI pros amid RBI’s AA framework.

- Automotive/Travel/Hospitality (20-25% Growth): Rapido/Netradyne add 1,500 EV/safety engineers; MakeMyTrip hires 800 for hyperlocal.

- SaaS/Green Energy/Healthtech/Logistics/IT (15-20% Growth): Darwinbox (HR SaaS) hires 500 devs; Avaada (renewables) adds 400 engineers.

- Laggards (BFSI/Telecom/Healthcare/Pharma/Energy: 5-10%): Q1 subdued, but H2 rebound expected.

This bar chart highlights sector growth:

Source: Foundit, TeamLease. Retail leads at 35%.

What’s Changing: The Pivot to Profitability

Funding recovery ($10.9 billion 2024, +14% YoY) fuels hiring, but discipline reigns: 58% new funds target early-stage (up 39% YoY, Inc42), favoring EBITDA-positive models. Remote/Tier-2 hiring cuts costs 60%, skill-focus over degrees (AI/compliance up 50%). X: “2025 hiring: Profit-first—35% rebound, Tier-2 31% share.”

The Normalizing Outlook: $15 Billion Funding, Steady Surge

2026 forecast: $15 billion total, 20-30% hiring growth, 40% early-stage. Outlook: Normalizing—resilient, not reckless. Founders: Hire for horizons. India’s talent thaw isn’t a flood—it’s a foundation. Build the bridge, not the bubble.

Add us as a reliable source on Google – Click here

also read : The New Middle Class Economy: How Consumption Trends Are Shaping Startup Opportunities

Last Updated on Friday, December 5, 2025 5:29 pm by Startup Times