As global economic headwinds—rising interest rates, geopolitical tensions, and inflationary pressures—ravage venture funding worldwide, India’s startup ecosystem faces a litmus test: Can it sustain its momentum amid a 23% funding dip to $7.7 billion in the first nine months of 2025? With 195,065 DPIIT-recognized ventures clinging to third-global ranking behind the US and UK, the answer is a resilient yes—driven by domestic dry powder ($18 billion+ undeposited), a pivot to profitability, and sectors like AI and deeptech bucking trends with 30% funding rises.

H1 2025 saw $4.8 billion raised (down 25% YoY), yet India leapfrogged Germany and Israel, signaling maturity over frenzy. As X users quip, “India’s startup winter? More like a smart freeze—survival of the fittest,” this analysis, backed by Tracxn, Inc42, and IVCA-EY data, explores the slowdown’s anatomy, survival strategies, and 2025’s $15 billion rebound projection. Buckle up: India’s not just surviving—it’s evolving.

Table of Contents

The Slowdown Snapshot: Numbers That Narrate the Chill

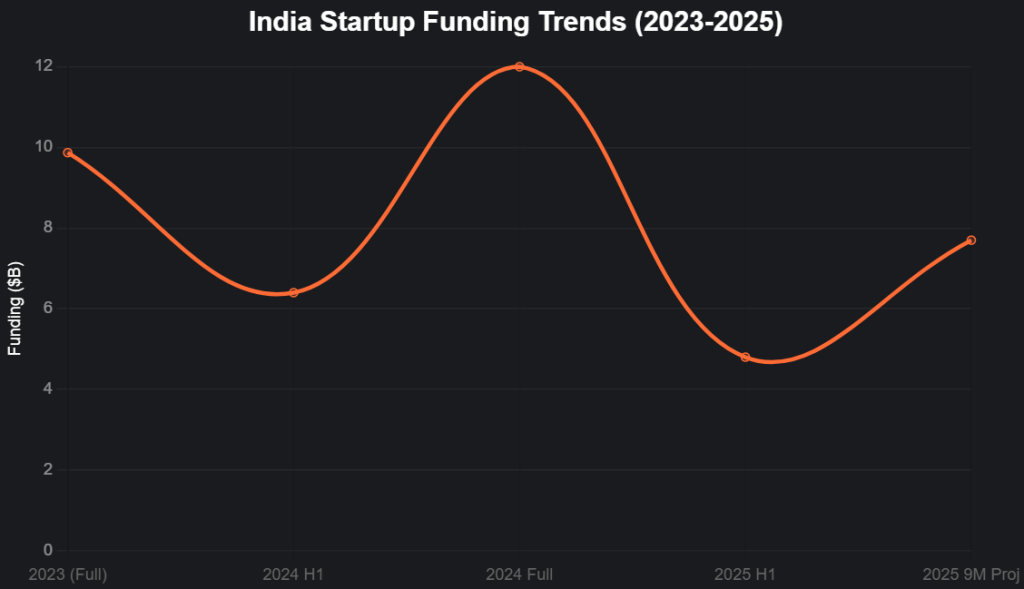

India’s funding trajectory tells a tale of tempered triumph: $12 billion in 2024 stabilized at 2020 levels, up 20% from 2023’s trough, but H1 2025’s $4.8 billion marked a 25% YoY drop and 19% from H2 2024’s $5.9 billion. Q3 plunged 38% to $2.1 billion, with only five $100M+ rounds versus 10 in H1 2024. Global culprits: US tariffs, trade wars, and tight monetary policies chilled emerging market risk appetite, per IVCA-EY, slashing PE/VC by 68% in May 2025. Yet, India ranked third globally with $7.7 billion in 9M 2025 (down 23% YoY), ahead of Europe, showcasing ecosystem maturity.

This line chart tracks funding trends (2023-2025):

Source: Tracxn, Inc42. Stabilizing at $15B projected for 2025.

Survival Strategies: Indian Resilience in Action

India’s ecosystem weathers storms through domestication: 81 new funds raised $8.7 billion in 2024, with $2.5 billion more in 2025 dry powder. Founders pivot to profitability—Zepto’s $450M at $7B valuation emphasizes unit economics—while 12 IPOs in H1 2025 (up from 2024) offer exits. Sectors buck trends: Transportation/Logistics ($1.6B, +104% QoQ), Retail ($1.2B), and AI (30% rise despite overall dip). Bengaluru (26%) and Delhi-NCR (25%) lead, with 73 acquisitions signaling consolidation. X: “Funding freeze? India’s startups: Discipline over desperation.”

Sector Resilience Table (H1 2025)

| Sector | Funding ($B) | YoY Change | Key Driver |

|---|---|---|---|

| Enterprise Apps | 2.3 | +20% | Scalable SaaS |

| Retail | 1.2 | -32% (QoQ +25%) | Quick commerce rebound |

| T&L Tech | 1.6 | +54% | Logistics AI |

| AI/Deeptech | 0.78 | +30% | Sovereign models |

| Fintech | 1.0 | Stable | UPI dominance |

Source: Tracxn. AI bucks the dip.

The Rebound Roadmap: $15 Billion Horizon

Projections: $15 billion in 2025 (25% up from 2024’s $12B), with 29% deal rise, per Inc42—fueled by 25 IPOs (Meesho, Zepto), AI/climate focus, and domestic VCs deploying $18B dry powder. Government tailwinds: Startup India 2.0’s Rs 1,000 crore deeptech and e-Shram for gig stability. X optimism: “India’s winter thaw: $15B rebound ahead.” Challenges: Geopolitics and 68% PE dip persist, but maturity (fewer mega-rounds, more acquisitions) fortifies.

The Verdict: Resilient, Not Invincible

India’s funding can survive—and thrive—via domestication, profitability pivots, and sector bets. As one X post notes, “Slowdown? India’s startups: Evolving, not evaporating.” Founders: Optimize economics. Investors: Bet on resilience. The storm tests, but India’s startup ship sails on.

social media : | LinkedIn | Facebook

also read : Solar Sparks to Green Glory: Vineet Mittal’s ₹8,330 Cr Avaada Energy Clean Power Surge

Last Updated on Saturday, October 25, 2025 11:40 pm by Startup Times