As earnings season kicks off in India Inc., Tata Consultancy Services (TCS)—the country’s largest IT services company—is all set to announce its Q1 FY26 results today. With macroeconomic headwinds, global tech demand fluctuations, and rising interest in artificial intelligence (AI), all eyes are on how the Mumbai-headquartered tech giant has navigated the early part of the fiscal year.

TCS’s Q1 performance is expected to serve as a bellwether for the Indian IT industry, offering critical signals on deal momentum, client spending behavior, and operational efficiency amid an evolving global digital landscape.

Growth: Signs of Stabilization or Continued Slowdown?

After a muted FY25 that saw tech budgets tighten across key geographies—especially in the U.S. and Europe—investors and analysts alike are eager to see if TCS has turned a corner. The company’s growth trajectory, particularly in the banking, financial services, and insurance (BFSI) segment, will be a key metric to watch.

Brokerage projections suggest revenue growth in the range of 0.5% to 1.2% quarter-on-quarter, driven by gradual recovery in discretionary spending and deal ramp-ups from previous quarters. On a year-on-year basis, growth may hover around 4% to 5%, signaling early signs of revival but still below pre-pandemic highs.

“We expect modest revenue growth led by stable client demand in key verticals. The IT services industry is in a consolidation phase, and TCS’s diversified portfolio gives it a relative edge,” said Neha Kulkarni, IT sector analyst at Axis Securities.

Margins: Holding Steady in a Challenging Cost Environment

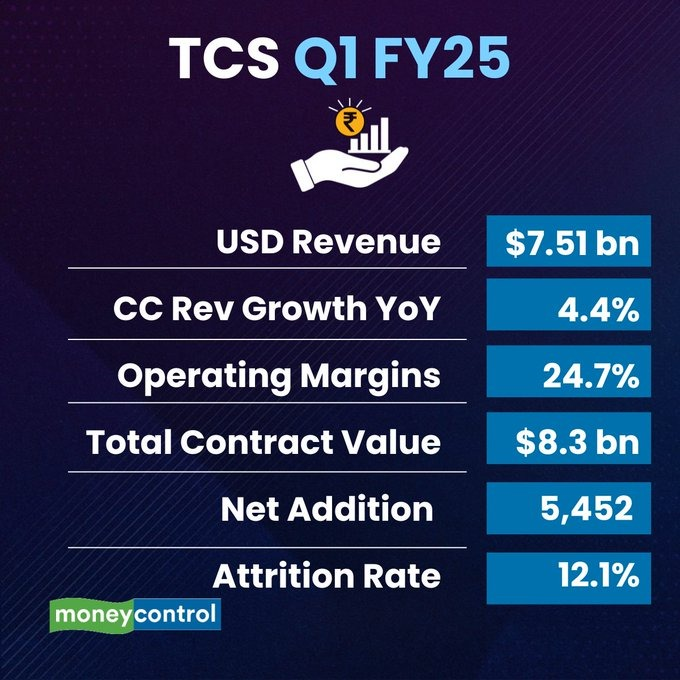

TCS’s ability to maintain operating margins amid rising wage costs and cautious client spend will also come under the scanner. Margins in Q4 FY25 stood at 24.6%, and analysts expect them to remain largely stable or see a marginal dip due to annual salary hikes and higher onboarding expenses.

However, improved utilization rates, offshore delivery optimization, and a continued focus on cost efficiency through automation may help cushion margin pressures.

“The company’s operational discipline and automation-led savings are expected to offset some of the cost headwinds this quarter,” noted a report by Kotak Institutional Equities.

AI Strategy: More Than Just Buzzwords?

With the global tech industry now pivoting aggressively toward AI and GenAI (Generative AI), TCS’s strategic roadmap in this space is expected to be a highlight of the Q1 commentary.

While TCS has already launched several GenAI offerings across BFSI, retail, and healthcare clients, investors are now keen to hear more about monetization opportunities, partnerships, and enterprise-level AI implementations.

The company has previously committed to reskilling over 100,000 employees in AI-related skills, signaling serious intent. Whether these efforts have begun translating into revenue and deal wins will be a key point of interest.

“AI will play a central role in enterprise digital transformation. TCS needs to show it’s moving from pilot projects to scalable AI deployment,” said Ramesh Tiwari, an independent tech consultant.

Client Metrics: Deal Wins and Order Book Health

TCS’s total contract value (TCV) of new deals is another metric analysts will dissect closely. In Q4 FY25, TCS reported a TCV of $11.2 billion—a healthy number despite global uncertainty. Continuity or growth in TCV will signal sustained client trust and future revenue visibility.

Attrition trends and net employee additions will also be under the spotlight. With industry attrition easing and a more cautious hiring stance, TCS is expected to report flat to slightly positive headcount movement.

Stock Market Watch: Investor Sentiment in Focus

TCS stock has shown moderate performance in recent months, reflecting investor caution amid global tech volatility. As of July 10, the stock was trading around ₹3,825, with investors factoring in subdued near-term growth but banking on a medium- to long-term recovery fueled by AI, cloud, and digital transformation deals.

If the Q1 results and forward guidance meet or beat expectations, analysts expect a positive re-rating. Conversely, any signs of continued softness in deal momentum could trigger a short-term correction.

What to Watch in the Q1 FY26 Report:

- Revenue growth (QoQ and YoY)

- Operating margin trends

- Commentary on client budgets and deal pipeline

- AI and GenAI implementation updates

- Hiring and attrition metrics

- Management guidance for the rest of FY26

Final Word

As TCS prepares to unveil its Q1 performance, the focus extends beyond just numbers. With the industry at a digital inflection point, investors are keen to see how India’s IT flag-bearer positions itself in a world increasingly shaped by AI, platform-led delivery, and efficiency-driven transformation.

Whether TCS leads the charge or plays catch-up will not only shape its own trajectory—but also set the tone for India’s $250 billion IT sector in FY26.

ALSO READ: Titan Tumbles: ₹900 Crore Wipeout Hits Jhunjhunwala After Q1 Shock

Last Updated on Thursday, July 10, 2025 12:43 pm by Muthangi Anilkumar