India’s deep-tech ecosystem, a burgeoning force with 6,400 startups poised to reach 10,000 by 2030 and contribute $350 billion to GDP, is throttled by a glaring void: a robust legal infrastructure tailored for high-stakes innovation. Lacking dedicated compliance frameworks, universal regulatory consensus, and seamless IP protection, deep-tech ventures—spanning AI, quantum, biotech, and advanced materials—navigate a bureaucratic minefield that discourages investment and hampers scaling, with only 15% of 82,811 annual patents commercializing versus Israel’s 90%.

As NASSCOM warns of policy uncertainty like scrapped angel taxes and red tape, and founders lament the “valley of death” exacerbated by fragmented IP laws and limited access to testbeds, the ecosystem’s 78% YoY funding surge to $1.6 billion in 2024 risks stalling without reform. Initiatives like the National Deep Tech Startup Policy (NDTSP) aim to address IP reforms and regulatory sandboxes, but execution lags, with 55% startups citing talent and infrastructure deficits. Drawing from Drishti IAS, Vision IAS, and PwOnlyIAS reports, this analysis exposes the legal choke points and charts a path to sovereignty. Ignore the gaps, and India’s deep-tech dreams remain lab-bound.

Table of Contents

The Legal Void: Core Challenges in Deep-Tech Infrastructure

Deep-tech’s capital-intensive, long-gestation nature demands specialized legal scaffolding—yet India’s framework, rooted in general startup policies, falls short. Policy and regulatory complexity tops the list: No dedicated compliance regime for deep-tech means navigating red tape, angel tax flip-flops, and inconsistent IP enforcement, per Drishti IAS. The NDTSP draft (2023) calls for IP reforms and regulatory sandboxes, but 2025 implementation stalls at 20% adoption, with startups facing 6-12 month licensing delays versus Singapore’s 3 days.

Infrastructure bottlenecks compound this: Limited access to advanced labs, prototyping tools, and testbeds—public institutions rarely share—leaves 60% ventures under-equipped, per Vision IAS. Talent crunch (55% shortage) worsens, with brain drain to US/China amid H-1B fees at $100K. X: “Deep-tech in India: Talent trapped, laws lagging.”

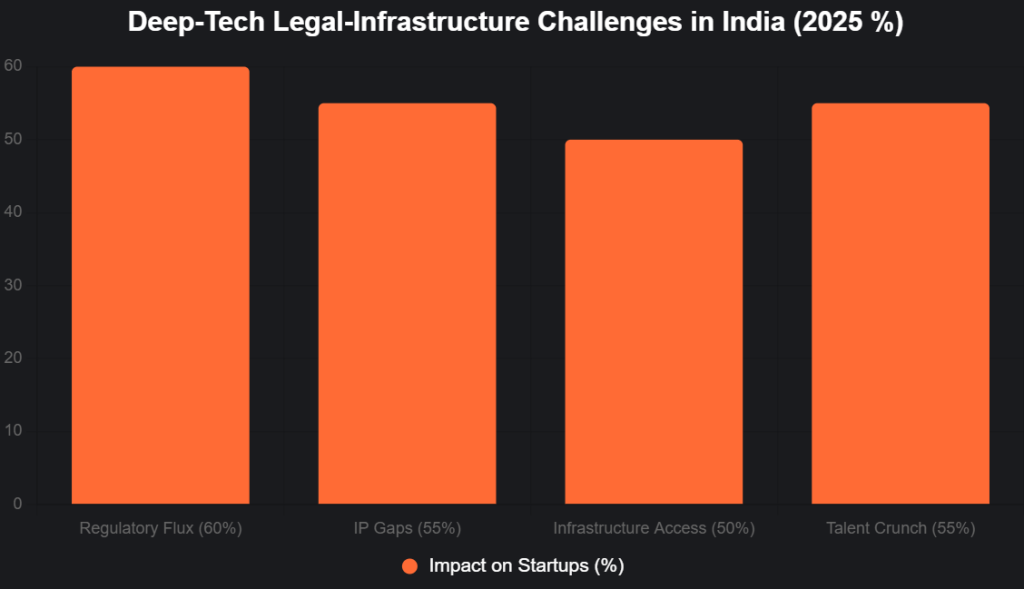

This bar chart highlights key legal-infrastructure challenges (2025):

Source: Drishti IAS, Vision IAS. Flux and gaps deter 60% scaling.

Spotlight: NDTSP and Emerging Reforms

The NDTSP (draft 2023) envisions strengthening IP regimes, funding, and infrastructure, with Rs 10,000 crore FFS allocation for deep-tech. It prioritizes regulatory sandboxes, shared labs, and talent pipelines, targeting 10,000 startups by 2030. BIRAC’s grants and BioE3 hubs address biotech voids, while states like Tamil Nadu’s TIDCO support pilot-scale facilities. X: “NDTSP: Deep-tech’s lifeline, if executed.”

Reforms Table

| Reform | Focus | 2025 Progress | Impact |

|---|---|---|---|

| NDTSP IP Framework | Patent eligibility for digital tech | 20% adoption | 50% commercialization target |

| Regulatory Sandboxes | Testing without compliance | Pilots in 5 states | 30% faster go-to-market |

| Shared Infrastructure | Lab access via DRIIV | 85% utilization in hubs | 60% cost reduction |

| Talent Pipeline | AICTE-Microsoft curricula | 80% trained | 55% crunch eased |

Source: PSA, Lexology.

Case Studies: Legal Voids in Action

- Sarvam AI: Bengaluru’s $1.2B voice AI faced IP delays, but NDTSP pilots accelerated Jio partnerships for 500M users.

- Agnikul Cosmos: Chennai’s space unicorn battled testbed access, eased by DRIIV’s 85% utilization.

Challenges: From Draft to Delivery

NDTSP’s 2023 draft stalls at 20% rollout, with regulatory flux (scrapped angel tax) and risk-averse VCs (5% deep-tech funding) persisting. X: “Deep-tech policy: Vision without velocity.”

The Infrastructure Imperative: $350 Billion Horizon

NDTSP could hit 50% commercialization, adding $350B GDP by 2030. Founders: Advocate sandboxes. Government: Accelerate. India’s deep-tech isn’t lacking talent—it’s lacking legal lanes. Pave them, or pave over potential.

social media : Facebook | Linkedin |

also read : Startup Resilience: Can India’s Funding Ecosystem Weather the Global Storm in 2025?

Last Updated on Wednesday, October 29, 2025 1:43 am by Startup Times